By Aurélie Sarrabezolles

IAM Research Director for Canada

On June 20, 2016, the Federal Government and the finance ministers of eight provinces agreed to expand the Canada Pension Plan (CPP), starting on January 1, 2019, and to be fully implemented by 2025. The provinces of Quebec and Manitoba did not sign the agreement.

This article in an overview of the reform. Another article with practical examples will follow.

Major Changes

- Both the employer and the employee will increase their CPP contributions by 1% over the five-year period, from the current rate of 4.95% to 5.95%

- The maximum income covered by the CPP goes from $54,900 to $82,700

- The retirement replacement rate goes from 25% to 33%. Currently, CPP pays retired workers 25% of their preretirement earnings. Under the new system, workers earning $54,900 a year would get a maximum annual pension of about $17,500 when they retire, an increase of $4,390 a year according to Department of Finance Canada

- The enhanced CPP contributions will be tax deductible

Benefits for you

Depending on your age group, your benefits will differ. Please note that in order to earn the maximum benefit, a worker will have to contribute the maximum amount for 40 years, once the new system is fully phased in after 2025.

- Workers under 16 YO: 100% of benefit

- Workers between 25-45 YO: 40-90% of benefit

- Workers between 45-65 YO: an average of less than 20% of benefit

- Retirees over 65 YO: zero benefit

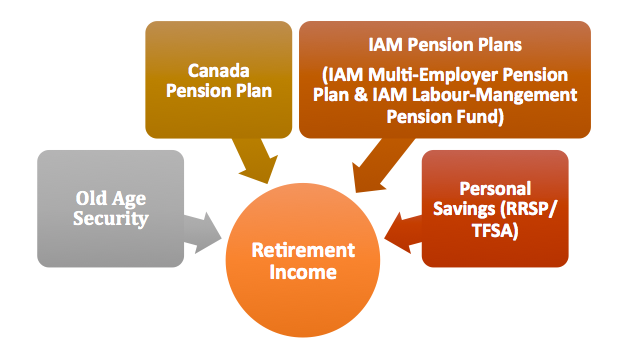

Canada’s Pension System applied to IAM Members

Overall, these change are good because they will help lower income workers when they retire. The priority of the IAM is to pursue the fight for better pensions for our members and for all the workers.

For more information on this topic:

Department of Finance Canada: “Background on Agreement in Principle on Canada Pension Plan Enhancement”: http://www.fin.gc.ca/n16/data/16-081_1-eng.asp